In this article, we will explore how to mark the structure in Smart Money Concepts, focusing on identifying valid and invalid market structures. Understanding structure mapping is crucial for making better trading decisions and avoiding common mistakes that lead to losses. Let’s dive into the topic step by step.

What are BOS and CHoCH?

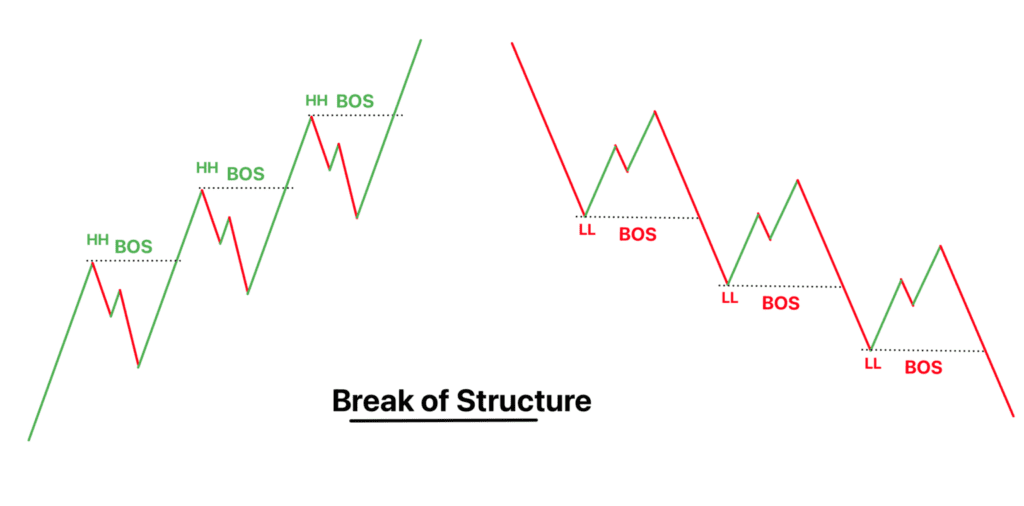

BOS (Break of Structure): When the market makes a lower low and breaks the previous low, or when the market makes a higher high, it indicates a trend continuation.

CHoCH (Change of Character): This signals that the market trend is changing. It occurs when the market, previously in a bearish phase, fails to break a lower low and instead breaks a recent lower high.

Key Points for Valid BOS and CHoCH

- Identify Recent Structure:

– For a bullish market, a higher high is considered valid only if it breaks and closes above the previous high.

– For a bearish market, a lower low is considered valid if it breaks and closes below the previous low.

- Pullback Requirement:

– After a BOS, the market must pull back at least 40-50% to confirm the validity of the structure.

- Valid and Invalid Structure:

– A structure is confirmed as valid if the market closes above or below the previous high or low.

– If the market fails to close above or below the identified structure points, it indicates an invalid structure, and no decision should be made based on this.

Live Chart Example: HDFC Bank (5-Minute Chart)

Identifying Break of Structure (BOS):

– If the market breaks the previous high and closes above it, this is a BOS.

– For instance, in the HDFC Bank chart, if the previous high is broken and the market closes above it, the BOS is confirmed.

Marking Higher Highs and Higher Lows:

– After a valid BOS, the recent low becomes the higher low.

– The market continues to make higher highs and higher lows until it fails to do so.

Identifying Change of Character (CHoCH):

– If the market, previously making higher highs and higher lows, breaks the recent higher low and fails to make a new high, this indicates a CHoCH.

– In our example, if the market breaks the recent higher low and closes below it, it signals a CHoCH.

Continuation of Trend:

– For the trend to continue, the market must keep breaking previous highs in a bullish market or previous lows in a bearish market.

– Any pullback within this trend must be deeper to be considered valid.

Conclusion

Understanding and marking the structure accurately is vital for successful trading. Many traders make mistakes in identifying valid BOS and CHoCH, leading to incorrect trades. Incorporating price action patterns, such as pin bars, engulfing candles, and head and shoulders, can provide additional insights into market direction and strength. Similarly, in algorithmic trading, patterns like moving average crossovers and trend-following algorithms can help automate the process of identifying BOS and CHoCH with greater precision. This blog aims to improve your understanding of structure mapping, whether you trade stocks, forex, or cryptocurrencies. Stay tuned for more in-depth content on Smart Money Concepts, where we will discuss order blocks, imbalances, entry models, and more.